How to Optimize Rent Pricing for Maximum Profitability Setting the right rent price for your rental property is one of the most important decisions that can directly impact your profitability. Rent too high, and you risk long vacancies; price too low, and you may leave money on the table. Finding the perfect balance is key […]

Why Multifamily Real Estate is a Safe Investment in Uncertain Times In today’s ever-changing economic landscape, stability is a sought-after quality in any investment. While some markets experience wild swings, multifamily real estate has proven to be a resilient and reliable asset class. Its unique combination of steady cash flow, inflation protection, and constant demand […]

The Power of Equity in Multifamily Real Estate: A Wealth-Building Tool When it comes to building wealth in real estate, equity is one of the most powerful tools at your disposal. Multifamily properties, in particular, offer unique opportunities to generate and leverage equity for long-term financial growth. In this blog, we’ll explore how equity works, […]

Why Location Matters in Multifamily Investments When it comes to multifamily real estate, the mantra “location, location, location” holds unparalleled importance. A property’s location is more than just an address—it’s the foundation for its success, influencing everything from tenant demand to long-term profitability. In this blog, we’ll explore the key reasons why location is crucial […]

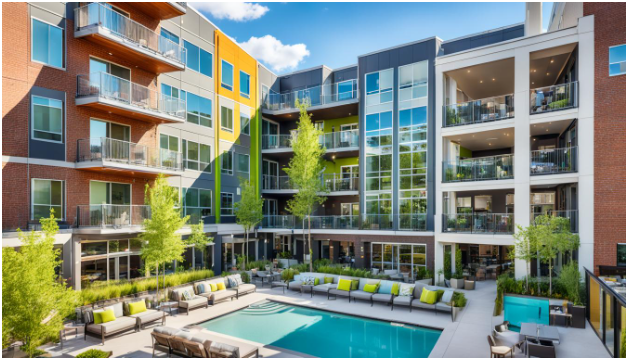

When it comes to multifamily real estate, many investors focus heavily on finding the right properties, securing financing, and analyzing market trends. However, one crucial factor that can significantly impact your investment’s success is property management. In fact, effective property management can be the difference between a profitable investment and one that underperforms. Why Property […]

Tenant Retention Strategies for Multifamily Property Owners Tenant retention is a key factor in maximizing the profitability of multifamily properties. High tenant turnover can lead to costly vacancies, increased maintenance expenses, and the need to constantly market and fill units. On the other hand, retaining long-term tenants helps stabilize cash flow, reduce operating costs, and […]

How to Find and Close the Best Off-Market Multifamily Deals Finding off-market multifamily deals can be a game-changer for real estate investors. Off-market properties, which are not publicly listed, often present unique opportunities to acquire high-value assets at a better price with less competition. However, identifying and closing these deals requires a strategic approach. In […]

Creative Financing Options for First-Time Multifamily Investors Investing in multifamily real estate offers a pathway to financial success, but securing financing can be a major hurdle, especially for first-time investors. The good news is that there are a variety of creative financing options available to help you acquire your first multifamily property. In this blog, […]

How to Conduct Due Diligence Before Purchasing a Multifamily Property When investing in multifamily real estate, conducting thorough due diligence is essential to making informed decisions and minimizing risk. Proper due diligence ensures that you’re fully aware of the property’s condition, financial performance, and potential challenges before making a commitment. In this blog, we’ll explore […]

Understanding Cap Rates and ROI in Multifamily Real Estate Cap rates (capitalization rates) and return on investment (ROI) are two of the most critical metrics investors use when evaluating multifamily real estate opportunities. Both play a crucial role in determining the profitability and risk associated with a property. In this blog, we will dive deep […]